Food for Thought: 2025 The Chinese Year of the (Ouroboros) Snake? Part II--The Ouroboros Is Chomping Away...

Ouroboros Part II: “Feel the Moment” and Imagine the Unimaginable

In Part I, I presented the Chinese New Year of the Snake (2025) with the idea that the snake this year will be more of an Ouroboros--a Snake/Dragon eating itself away with the prospects of renewal or rebirth once it is finished. What made this even more relevant is the fact that the Year of the Snake follows the Year of the Dragon. The idea behind Part I is that it's publishing occurred shortly after the start of the Chinese New Year of the Snake which coincided with the announcement of the Chinese AI company, DeepSeek causing a huge, perhaps temporary disruption in the Artificial Intelligence (AI) world. Here is a link to Part I: https://www.invest-a-vision.com/blog/2.

Now I get to feel the moment as more and more journalists are using the Ouroboros analogy when discussing the “circular” financing activity triggering the tremendous rally behind AI related stocks and the build out plans for data centers meant to fuel the demand for AI services and creations. This circular financing trend has also been referred to as vendor financing and “Round-Tripping”. Could it be getting Too Big to Fail? Is this the Ouroboros on a Feeding Frenzy?

I am really intrigued with the Ouroboros symbol and its meaning. It feels like 2025 has consistently demonstrated the Ouroboros at work or the act of eating away potential damaging activities. and perhaps attacking the chaos. Part I was hinting at a certain skepticism in the dynamics of AI and what the challenges and fortunes it promised.* There has been too many circular deals promoted or instigated by OpenAI which imagines at least $1 trillion capital investment to build the necessary infrastructure to power the demands of AI. Nvidia, Microsoft, Oracle, Meta, Xai, Amazon, AMD, Broadcom to name a few have all jumped on board.

This activity conjures up images of the Ouroboros chomping away (a bursting of the much discussed AI “bubble”) or the act of self-destruction which hopefully leads to a positive rebirth. Still as mentioned above, is this huge investment activity and concentration of interests creating a situation of too big to fail? If the bubble bursts, will the damage be so great convincing the markets and people or constituents that there will be political implications? It seems the markets have been undisturbed by the economic (tariffs and Federal Reserve independence), social and political chaos and uncertainties in 2025. Perhaps it doesn't consider it chaos and are content to simply participate in the rising prices. Somehow political, social and economic issues will become more influential in 2026 as we approach the Mid-Terms.

Circular investing coupled with a massive concentration. Are they eating each other or is the Ouroboros just getting fatter? It seems when anybody including experts ask, “Are we in a bubble?” will predominantly get an answer, "yes". Everyone seems to be convinced we are in a bubble and still the bubble expands or better said, inflates, reflecting the nearly daily announcement of yet another deal. The last one and perhaps the last straw was Amazon’s. The demand for data centers and the infrastructure is real and the only question is will the demand for AI services be enough to make it pay. OR will there be enough affordable energy and resources to power this demanding infrastructure? Until now, the strength of internet services esp. social media is the practically cost free data sourcing. Copyright laws, defamation and health controversies may challenge those models. Are we ignoring the idea or possibilities that the implementation of new rules or regulations making platforms accountable for illegal and/or fake information will alter the high margins due to altercations in the business models of the various players? The Ouroboros chomps away….

Is "Bubble" History Repeating Itself?

More and more experts discuss market (bubble) parallels to the DOT.COM Boom and Bust. In December 1996, the Federal Reserve Chair, Alan Greespan warned of "Irrational Exuberance" in the markets, but markets and esp. Internet related shares continued to rally only peaking in March 2000. Huge investments were made in communications infrastructure, mainly fiber optics, telecom equipment, routers creating a huge oversupply and an eventual bust. This is only the USA part of the story. China is also in the race and has vast investments in energy generation which will eventually fuel Data Centers and other electricity networks. Both China and the USA want to dominate the AI universe, the race is on.

Possible triggers for bursting the bubble?

1. Currently the high valuations in the equity market especially the CAPE-Shiller indicator allows experts to compare the current “bubble” to the DOT-COM bubble in 2000.

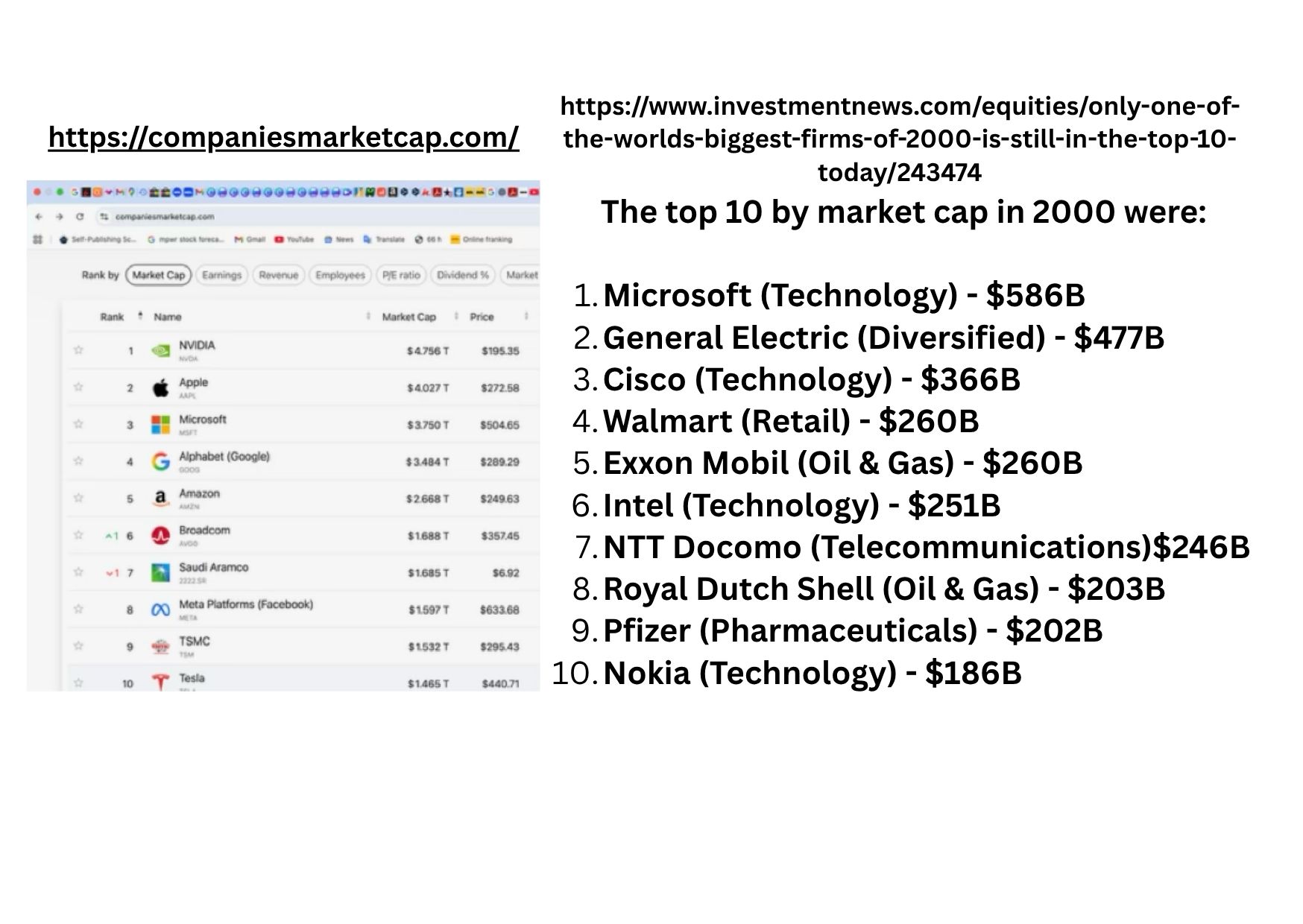

Here are a couple comparisons to the DOT.COM bubble:

Market Capitalizations are "over the top": Nokia at its peak in March 2000 — Extraordinary at that time. It was approximately #5 globally after Microsoft, GE, NTT Docomo and Cisco. Nvidia at $5 trillion market cap —roughly 17 percent of the gross domestic product of the United States, or about twice the GDP of Canada. And it’s roughly 8 pct of the S&P 500! Also extraordinary. Currently Nvidia's high market cap is followed by Apple, Microsoft, Alphabet, and Amazon. Saudi Aramco and TSMC are the only non-USA companies in the top 10 market cap companies.

"The CAPE ratio, also known as the Shiller P/E ratio, assesses the stock market's pricing by adjusting past earnings for inflation over a decade. Popularized by Yale's Robert Shiller, it gives investors insight into whether markets are undervalued or overvalued based on historical earnings data.Historically high CAPE ratios can signal potential market corrections, as first observed in 1997 and later validated during the 2008 market crash." Source: https://www.investopedia.com/terms/c/cape-ratio.asp

CAPE-Shiller (Green Line) Peaks: Perhaps we should rather compare current market valuations to the 1966 “Nifty Fifty” Peak including rising bond yields (red line) and low GDP growth (blue line)

The CAPE-Shiller is currently about as high as the 2000 peak. This makes investors nervous. The year 2000 like 2007/08 peaked and then crashed in an extended period of falling 10 year yields (red line). Now we have the threat of further rising rates not unlike the 1960s and ‘70s. I wonder lately why we don’t compare the current market rally to the one of the Nifty 50 in the ‘60s. That was also a time and market of concentrated top companies dominance (50 Blue Chips) which were destined to rise forever! CAPE-Shiller was at a relatively high value of over 20 and as you can see above, its valuation bottomed when rates peaked.

Still the 60s and ‘70s were a volatile time economically and politically with an oil crisis creating high inflation and economic stagnation or “Stagflation”. Stagflation reminds me of the my own experiences in the late 1970s, living and studying in California as the Ecology Movement was picking up steam and as a reaction to the Nifty 50 boom and bust, sustainability and anti-material (hippie) lifestyles were en vogue. It was not a time of despair, but rather discovery and experimentation of new ideas. Stagflation is not exciting for the markets and should be avoided , but we may have to pass through it as we adjust to the new world order—discovery and experimentation. Perhaps we can compare this alternative attitude highlighted in a recent article in The New Yorker (https://www.newyorker.com/culture/infinite-scroll/its-cool-to-have-no-followers-now ) The article discusses the new trend of limited followers on social media as the new cool: “It’s Cool to Have No Followers Now.” In other words corrections in the markets alter people’s attitudes. In this case, one may call it the Ouroboros Effect as all the negativities associated with Social Media get eaten away and replaced with new discovery and experimentation.

Yes, History Repeats Itself! This piece I published in 2014 does a similar comparison of the situation in 2014 with the early 30s culminating at the Berlin Olympics of 1936 as written about in the book, “The Boys in the Boat” by Daniel James Brown. 2014 and the early 1930s were both post market crash periods and recovery. (Link: https://acrobat.adobe.com/id/urn:aaid:sc:eu:959f21e3-94f9-4e52-8c8e-34f7af2c20b5)

At the end of the above attached piece is another reflection of the market, notably the S&P500 during the Years of the Snake, the Horse and the Goat. The Year of the Horse (next year 2026) is mixed, mostly experiencing corrections and then recovering in the Year of the Goat.

Source: ChatGPT

Source: ChatGPT

2. Debt failure is probably what triggers a bubble burst—share valuations return to the mean**

The Ouroboros final bite of the bubble may not be a question of high stock valuations or anything to do with AI as that has been so widely discussed. It might not even reflect loosening or tightening monetary policies, but rather something more Macro like a country faltering on its debt obligations or those shadow banks failing due to over indebtedness. We don't speak much about the 1998 Russia Debt Default which brought down Long-Term Capital Mgmt (LTCM) and perhaps should be seen as the precursor to the 2000 equity bubble burst.

Margin Calls. Artificial Intelligence like Crypto is resource dependent/hungry and so in order to make it commercially viable, the costs of energy will have to go down coupled with greater efficiencies. The big theme in 2026 will be affordability so price pressures will be immense—deflation? Deflation implies lower economic growth, but could also mean lower margins. How this plays out in the markets is anyone’s guess. A return to the mean for valuations will perhaps have investors concentrate on cheaper quality (defensive) stocks and less on the expensive ones. A bit boring, but if the Ouroboros has his way, he will lay the basis for a new experiment where it may end up being cool to be green--being one with nature, hardware innovations--new discoveries (robots and automation) for a universal improvement in the quality of life, but also a bit more, dare I say, analog. It might help if those billionaire Tech Bros rediscover the Art of Taking Risks by investing more in a social contract and join in Imagining the Unimaginable!.

Happy Holidays!

Stephanie Haight-Kuntze, www.Invest-A-Vision.com, Berlin, Germany

P.S: Some Ouroboros After-thoughts:

“We might have to put DOGE on Elon,” Trump said about the federal cost-cutting effort. “DOGE is the monster that might have to go back and eat Elon. Wouldn’t that be terrible?” Bloomberg July 1. 2025

“We might have to put DOGE on Elon,” Trump said about the federal cost-cutting effort. “DOGE is the monster that might have to go back and eat Elon. Wouldn’t that be terrible?” Bloomberg July 1. 2025

It seems President Trump is challenging the US Constitution in its entirety. He has essentially eliminated the balance of power by usurping the power of the purse and the official declaration of war and dismissing programs that had promised funding from Congress. Many of these programs were soft diplomacy programs for those in need. He is challenging his allies by forcing them to carry their fair share for their own defense. Europe can no longer take America's military defense prowess for granted at a time when it is badly needed along with energy scarcity. It looks like it will all become transactional as Europe will buy weapons from the US not only for their own defense needs, but also in their support for Ukraine.

Through all these actions, the Ouroboros is chomping away at the presumed security of Law and Order at home and the loss of trust from both friends and foe abroad. With all this dramatic change, there is a growing sense that these actions have crossed that red line. The resistence is growing.

Bernie Sanders has been making the rounds on a number of podcasts. He made a very popular speech at the "No Kings" protest rally in Washington D.C. He has emphasized something powerful and frightening that Donald Trump has been correct at calling the US political system esp. the one in Washington DC as broken. He is of course critical of the Republicans' method of breaking it completely and then creating a new one under the guise of authoritarism and religion. Still by recognizing that the system is in disrepair, why not come up with a solution in modernizing the Constitution giving the power back to the people. The basis for the existing constitution can stay, but there have to be new rules to prevent future coups or a concentration of power in a single branch. Take corporate funding out of politics. Make policy fair and free for everyone. I'm sure there are many more and better ideas out there. The need for constructive change and improvement should be on all parties' agendas.

Many say this destruction of the status quo is irreversible. What would a rebirth look like once the Ouroboros has finished? Well, probably it will involve both high tech esp. AI replacing much of the bureaucracies. AI systems will most likely replace several layers of the bureaucracy creating greater efficiencies, but also utilizing the experience and intelligence of seasoned federal employees. The AI systems will create revenues and cash flow for the innovators. These systems will also be implemented at large corporations. We have all witnessed certain jobs being made obsolete due to the internet. This should not be a shock. Only the aggressive methods being currently implemented without a systematic strategy and mostly chaos doesn't need to be. Energy demand is another economic challenge and it is obvious that there will enough demand to warrant greater investments in alternative energies.

Finally, the Ouroboros has not been so active on the stock market. Still my closing food for thought is that disappearance of a working democracy will also eat away at functioning capital markets. Both require rules (regulation) and trust. The concentration of power in Washington and Russia and China threatens democracy and the concentration of power in tech, the media and energy threatens the capital markets. Concentration makes it easier for the Ouroboros to swallow and then what?

Let's get back the Power to the people!

Links:

2025 Chinese New Year of the Snake or Rather Ouroboros Part I: https://www.invest-a-vision.com/blog/2.

*Circular financing: https://www.bloomberg.com/news/articles/2025-10-08/the-circular-openai-nvidia-and-amd-deals-raising-fears-of-a-new-tech-bubble?utm_source=website&utm_medium=share&utm_campaign=copy

The Podcast "Prof G Markets" describes these big OpenAI deals with Oracle and NVIDIA as circular in nature and maybe overextending -- (https://podcasts.apple.com/de/podcast/prof-g-markets/id1744631325?l=en-GB&i=1000728190076). Other chipmakers are also benefitting and offering their own solutions in competition with Nvidia. Spotify: https://open.spotify.com/episode/2SVuWhu0cUwp8ZeKuQzz7l?si=52aXTwJhQyaYyqJWiE0pug

Plain English _AI Bubble? Many direct comparison of the current Data Center Investment ~60% on Chips) to the over spending on Infrastruktur Hardware (Telecom/Cisco) in the late 90s — Internet survived but many of the companies did not. Another argument about the dependencies on Nvidia including the US GDP growth.

https://podcasts.apple.com/de/podcast/plain-english-with-derek-thompson/id1594471023?l=en-GB&i=1000728026459 / Spotify: https://open.spotify.com/episode/2p94kBX0geqMMY1XXdZFvA?si=rB5-wellRVOwDWIN6v3SWw

Better Offline w/ Ed Zitrone: In this week's Better Offline monologue, Ed Zitron talks about OpenAI hinting they’d want a federal backstop for data center loans, NVIDIA’s weird, desperate post about China, and his deep suspicion about OpenAI’s leaked numbers. https://podcasts.apple.com/de/podcast/better-offline/id1730587238?l=en-GB&i=1000735666839 / Spotify: https://open.spotify.com/episode/6JX5dB5bas79zw27EBSTqv?si=CUMlkph0Qsyx40Jle9vYdA

The New Yorker (https://www.newyorker.com/culture/infinite-scroll/its-cool-to-have-no-followers-now ) The article discusses the new trend of limited followers on social media as the new cool: “It’s Cool to Have No Followers Now.”

"History Repeats Itself: Market Parallels to the ‘30s Financial Crisis Inspired by a Book https://acrobat.adobe.com/id/urn:aaid:sc:eu:959f21e3-94f9-4e52-8c8e-34f7af2c20b5)

Capitalism Becomes One With Nature: https://podcasts.apple.com/de/podcast/invest-a-vision-iav-define-your-vision-reach-your-goals/id1591798494?i=1000541019563 // Spotify: https://open.spotify.com/episode/4tI2CM9Fx1V2mPR1Go6nng?si=_du4qQRmQgmSbZjNDV5S9A

**The Odd Lots podcast (Bloomberg) has been around for 10 years. Unfortunately, markets have gotten less rational over the same time frame. At least this is the contention of Cliff Asness, the co-founder and CEO of AQR Capital Management, a quantitative investing firm that's been around for nearly three decades. Asness' approach to investing is rooted in academic theory, having studied under the legendary Eugene Fama at the University of Chicago. In the world of social media and meme stocks, it's tough out there for the academically minded. And that's forced Cliff to adjust his approach over time. On this episode, we talk about the history of quantitative investing, market efficiency, and the emergence of AI/ML in his process. We also talk about the reality of investing other people's money, and the challenge of sticking with one's convictions at a time when temporary forces are working against you. https://podcasts.apple.com/de/podcast/odd-lots/id1056200096?l=en-GB&i=1000736563747