Out Goes the Observant (Circular) Snake-Ouroboros and In Crosses the (Red Line) Powerful, Bold & High-Energy Horse!

Happy Chinese New Year of the Fire Horse!

Imagine the Unimaginables for 2026

“Predicted volatility; fortune favors the brave but tests the unprepared”

In my financial career in institutional equity sales, I always took delight in conjuring up ideas or events unimaginable that could happen and the markets have yet to discount. Food for Thought. So I thought this year I would carry on the past tradition by combining events unimaginable in 2026 with the transition into the Chinese New Year of the Fire Horse starting on February 17th. We are now experiencing the end of the Year of the Snake which I chose to call the Year of the Ouroboros. The discovery of the Ouroboros symbol, a Dragon-Snake forming a circle by eating its tail which meant it devoured negative disruptions resulting in a kind of positive rebirth (my interpretation). Here are links to my two Ouroboros-Year of the Snake Blog pieces: https://www.invest-a-vision.com/blog/2 and in the second one: are hints of Unimaginables published in late November 2025: https://www.invest-a-vision.com/blog/food-for-thought-2025-the-chinese-year-of-the-ouroboros-snake-part-ii-the-ouroboros-is-chomping-away

The magic of the Ouroboros symbol is that it is circular in nature. 2025 and the Year of the Snake started January 29, 2025 can be easily characterized as highly disruptive and circular. Yet it is said to eliminate what’s bad and make room for a rebirth of something good and better. The crazy thing is that the disruption hasn’t necessarily eliminated what’s bad and wrong, it has actually highlighted it to such an extent that the leaders of democracies have found courage to withstand and create a better world. Call it Davos 2026 with Mark Carney, Prime Minister of Canada’s speech. A redefinition of exerting power and recognizing one’s strengths and use courage to fight self-defeating disruptions in favor of positive balances and outcomes for the people. He called it a rupture.

“Mountain air can be clarifying. In Davos, European leaders have been able to breathe in the fact that America is no longer interested in European security and may even be a threat to it. The choice is clear. Europe can remain a vassal of the United States, without being able to count on its protection. Or, by coming together, it can take control of its own destiny.”

(https://www.nytimes.com/2026/01/23/opinion/trump-greenland-nato-europe.html?campaign_id=39&emc=edit_ty_20260123&instance_id=169737&nl=opinion-today®i_id=75316253&segment_id=214123&user_id=7464c69db002dd3ce450a92a5ce2adb4)

It is also more evident around the world that there’s no going back and so to go forward, we have to come up with solutions that work for everyone. NATO worked 80 years and the US constitution for 250 years, take the best and working parts and reconstruct them both to work in this modern era: liberty, equality, checks and balances, the rule of law, and power to the people.

The Ouroboros Effect in 2025:

1) The quest for AGI (Artificial General Intelligence) with OpenAI declaring the need for capital investments of up to $1 trillion! The announcement of China’s DeepSeek breakthroughs placed some doubts on the numbers, but it didn’t stop it, in fact it triggered it as the USA must stay ahead of China. The race started in chips, data centers, energy sourcing infrastructure. This created circular financing techniques (vendor financing) and a concentration of tech stocks in major indices (Magnificent 7), speculations of bubbles, too big to fail which implies going full circle.

2) The second and more intentional disruption in 2025 was the Trump 2.0 Agenda. Flooding the zone with new measures, many emergency declarations making everyone run in circles. DOGE, Tariffs, Ukraine support / no support, deportations, attacking FED Chair Jerome Powell jeopardizing FED independence, promising peace and yet bombing successfully Iran and Venezuela and contemplating a possible forceful acquisition of America’s NATO Ally, Greenland (Denmark)!

“We might have to put DOGE on Elon,” Trump said about the federal cost-cutting effort. “DOGE is the monster that might have to go back and eat Elon. Wouldn’t that be terrible?” Bloomberg July 1. 2025

Some speculate Trump has turned on his base as he ventures into foreign interventions, releases the Epstein Files long after the due date, enriches himself as the cost of living remains a challenge for many Americans, etc. Still when you look at the table below, characteristics defining the year of the snake were pretty much elusive in 2025, but were they?

The Chinese Year of the Snake is typically characterized by the following:

|

Feature |

Year of the Snake (2025) |

Year of the Fire Horse (2026) |

|

Pace |

Slow, deliberate, and strategic. |

Fast, energetic, and spontaneous. |

|

Focus |

Introspection, wisdom, and "shedding" old habits. |

Movement, freedom, and bold execution. |

|

Element |

Wood (Growth, flexibility). |

Fire (Passion, intensity, leadership). |

|

Core Theme |

Transformation: Deep inner work and planning. |

Momentum: Action-oriented progress and social expansion. |

Source: Gemini AI (see links to various Chinese Year of the Fire Horse discussion in the Appendix below)

The Year of the Fire (red) Horse starting on February 17, 2026 looks to be a quite exciting one, perhaps with the same energy but with more positive implications or outcomes. Actually, it will be mostly characterized by “Crossing Red Lines” or better yet, in Mark Carney’s words, “The Rupture!”

This brings me to my first Unimaginable:

#1) The Europeans and the American Democratic Party, often referred to as “Woke” take ACTION! Unimaginable! It has become existential for both to rise up!

Throughout 2025, especially since President Trump came back in power, the Europeans and the Democrats appear to be completely paralyzed and often subject to infighting and lacking a cohesive, collective mandate. Easy to take advantage of and Trump and his MAGA followers did, as did Russia. I suspect everyone on all sides were overwhelmed with the ferocity and magnitude of Trumps Emergency Measures and daily new announcements, policies and implementations. He is given powerful, rich and collaborative support making it difficult to stop him, but in a way this strategy may be going full circle and the Ouroboros is starting to eat it away.

The Europeans and maybe even the Democratic Party are facing real existential threats. The war in Ukraine, competitive disadvantages, risk adversity, old ideological obsessions, disunity and complacency have caught them unprepared. Their huge amount of wealth has to be put to work and invested. Simply by finally recognizing this will spur them on to action. That will take hold in 2026!

So imagine his adversaries and democratic forces have taken notes and created a quiet strategy in 2025 (Year of the Snake) to take action and strike back in the Year of the Horse. They get wise and most importantly “shed” old habits, habits that have failed them in order to re-build a more viable future framework which still embraces the constitutional basis of Rule of Law, Respect for Liberty, Equality and Power of the People with the necessary Checks and Balances. It will be lean and smart. Unimaginable? They take action and there is no stopping them.

The Europeans are now forced to find common ground and are joining forces with other middle powers, Canada, Australia, Japan, Korea to name a few. All are proud and working democracies and all want to deliver what’s best for their people and for the alliance. They will invest in their own defense and in open trade agreements. They may even implement a strategy in creating a united capital market structure. Unimaginable!

One message they can all remind the world of: Democracy AND the Capital Markets work best under the prevalence of Trust and Fairness, Basic Regulation and Equality (information, pricing, transparency to name a few). By trying to challenge the democratic spirit, there is a parallel danger of significantly damaging stock and bond markets and even the dominance of the US dollar.

We will look back on 2025 as a revolution against the status quo, a time to move fast and break things and even experiment, but the many actions taken were steps too far, in some cases crossing the red line. Those actions are coming back to bite…the Ouroboros strikes!

The Red Lines:

The threat to takeover Greenland, part of Denmark, a dedicated NATO ally. Continuous Russian bombing the Ukraine.

Ignoring Congressional mandates for spending, cutting promised aid, traditional soft-powers and using military power abroad.

Attacking protesters and arresting/killing US citizens in mostly Blue States, ignoring their rights and consistently anyway ignoring constitutional laws.

Unimaginable #2): Talk of the Tech Bubble dissipates until it doesn’t...

The American stock market continues to rally, but not necessarily being lead anymore by the Magnificent 7 Tech shares. There is greater focus on valuations emphasizing greater diversification into small caps, value shares and foreign markets. The Tech-AI (Artificial Intelligence) bubble scare in H2 of 2025, the circular financing strategy (vendor financing) or “Round-Tripping” and huge capital commitments from companies not used to such a thing (except Amazon) has drawn up comparisons to the Dot-Com boom and bust. Could it be getting Too Big to Fail? Is this the Ouroboros on a Feeding Frenzy?

There is an obvious race among the AI companies to be no. 1—Winner takes All. This race could be casuing too much capital investing and creating a scarcity in liquidity. Bubble talk could return if the 2026 earnings do not deliver the growth implied in current valuations. Some would say this change of favor away from Big Tech is unimaginable. Also what if Social Media Platforms are subject to considerably more regulatory oversight??? Ruinous for their business models? Unimaginable.

The Red Lines:

Cost of electricity and water explode, electrical outages due to the build out of Data Centers

Financial sourcing or liquidity becomes scarce due to overvaluations killing momentum

Explosion in ads all over one’s feeds driving people away (see Unimaginable #6),

Increasing demand for more regulation of social media and their use of algorithms -- will this lead to a more restrictive Section 230 and/or business model challenges?

Unimaginable #3): Consume or Not to Consume

Tariffs legality and what happens to Jerome Powell, Chairman of the FED and the policies of his successor will influence trust and volatility in stocks and bonds. Trump is hoping that income from the Tariffs will help in refinancing America’s debt, but if it is declared illegal, he will most likely have to get Congress to approve his tariffs and this is in an election year. Any challenge to the independence of the FED will challenge the demand for long term bonds. Still fiscal stimulus may be enough to keep economic growth strong together with consumer demand. Affordability will be the main theme in 2026 and if shelter prices stabilize and maybe decline and re-financing gets cheaper then consumption should benefit.

The Red Lines:

Inflation accelerates due to higher electricity prices and tariffs causing supply chain uncertainty and possible higher oil and gas prices (see #4 below)

Tariffs and Federal Reserve Bank Independence created very short term chaos creating buying opportunities—circular action—conjuring up notions of insider activity and real wealth uncertainty?

Unimaginable #4): Alternative Energy esp. Solar Power beats Oil

Oil prices are expected to fall which is good for consumers, challenging for not only oil, but also alternative energy sources. Still given the choice, alternatives, esp. solar might just win out. Falling oil prices will put considerable pressure on Russia and their war effort in the Ukraine. This may also fuel confidence in Europe (unimaginable #1). Which side will America take? Cheaper oil certainly would help Trump so that might make it more imaginable. Nobody talks about it, that is alternative energy, but alternative pricing may even climb while oil doesn’t due to the overwhelming electricity demand. What is really unimaginable--US oil companies invest in greater exposure to alternatives!

The Red Lines:

China is the main producer and supplier of solar panels which could be restrained due to geopolitics and tariffs.

Oil prices actually inflate due to geopolitics, i.e. Iran, destruction of shadow fleets limiting supply.

Unimaginable #5): Another Bubble—Gold, Silver, Commodities? US Interest Rates actually stay steady?

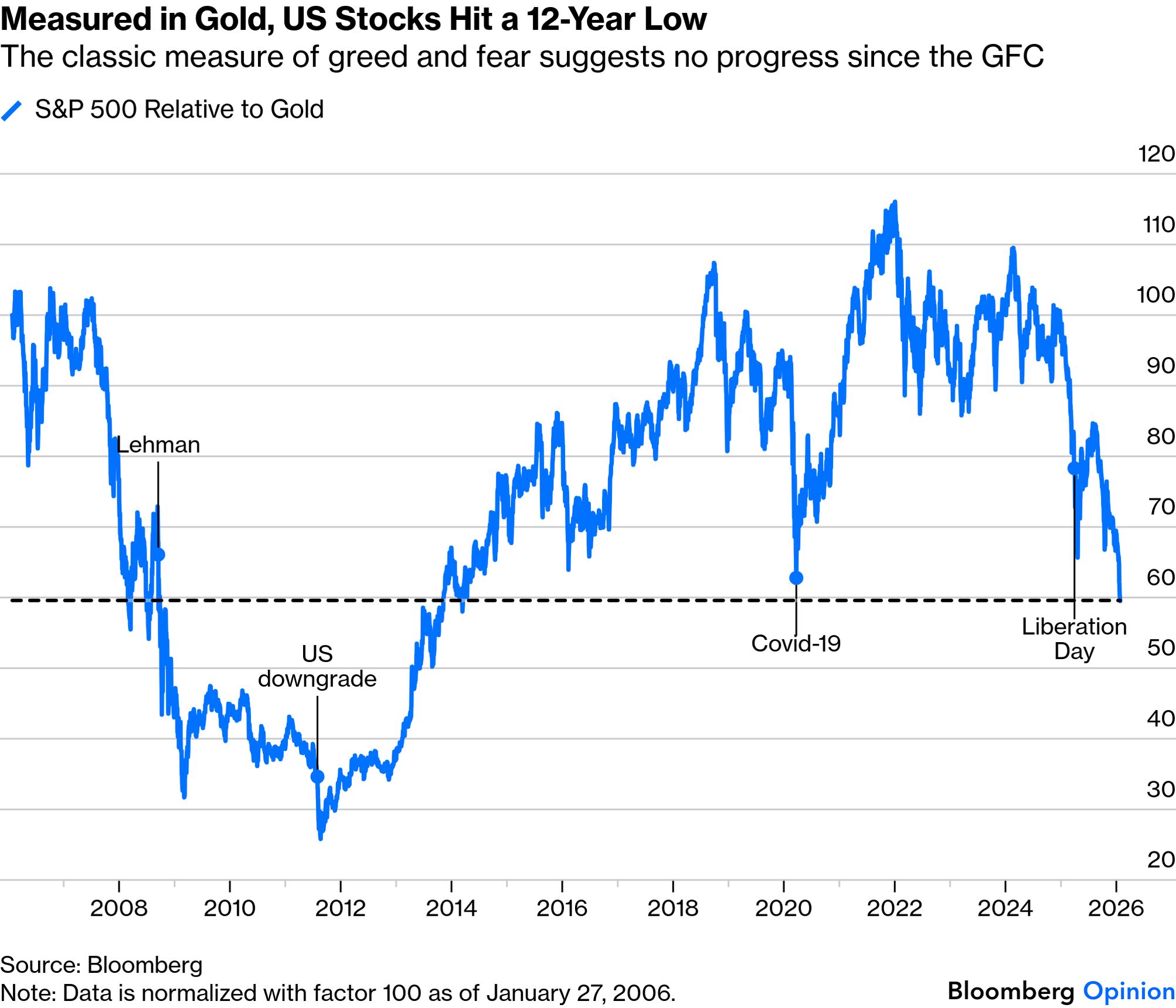

Perhaps the chart below from John Authers, Bloomberg, Opinion Points of Return, January 27, 2026 can explain whether or not the rally in .Gold and other metals reflect the debasement trade. Keep in mind, the last Year of the Horse in 2014 truly favored the S&P500 over Gold. (See History Repeats Itself in the Appendix**). Debasement implies that the world is losing its faith in the almighty US dollar. With an incredibly robust economy coupled with tamer than expected inflation and stable unemployment, interest rates cannot justifiably be cut. This is not priced in.

From John Authers, Bloomberg:

"Arguably, a move to strengthen the yen by weakening the dollar also helps precious metals, which generally function as the inverse of the dollar. Gold is at an all-time record — an unusual state of affairs when growth appears robust and yields are rising — and sends some alarming messages. Price the S&P 500 in gold rather than dollars, and it’s easy to sustain the narrative that the rally of the last decade has rested on debasement:

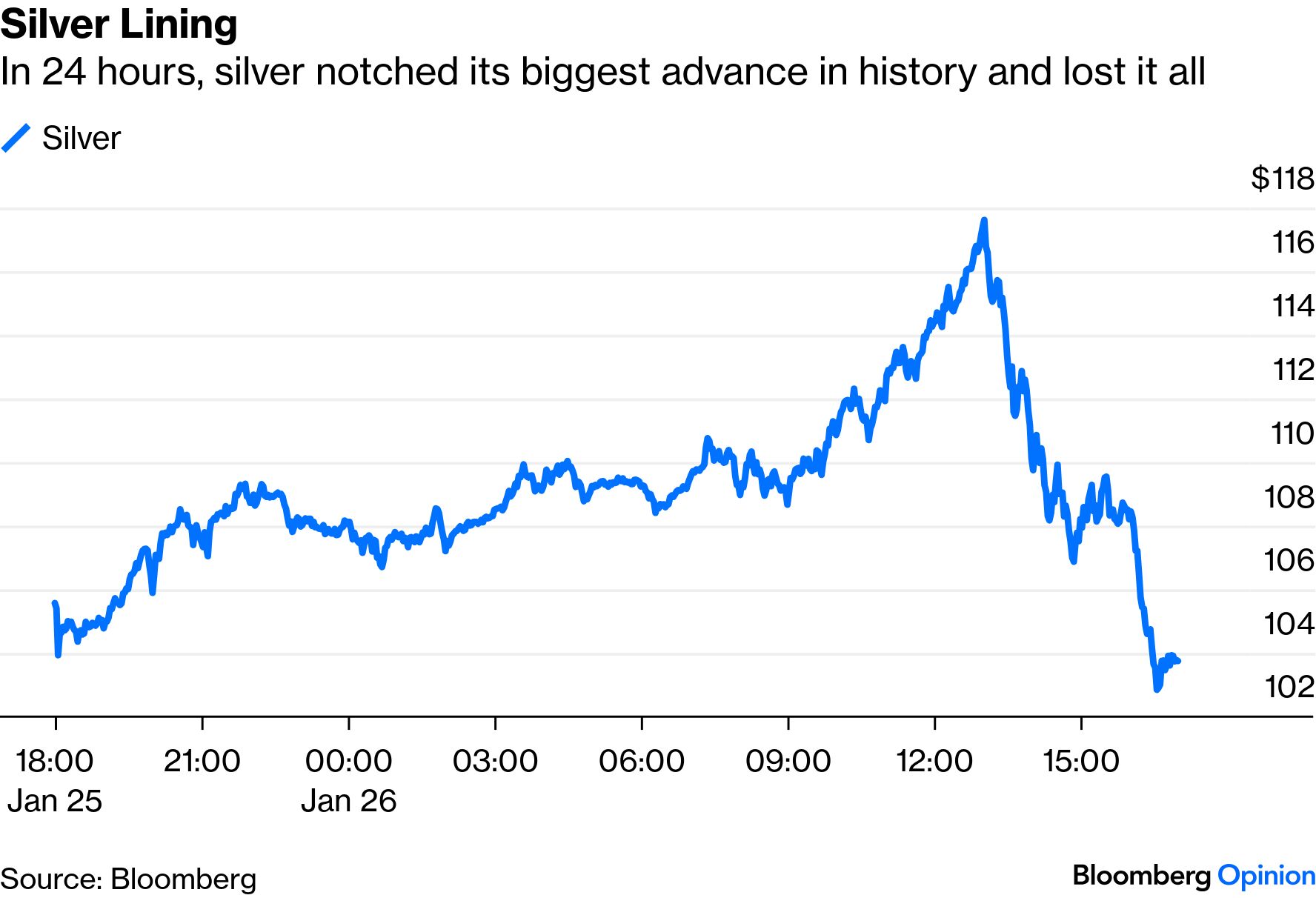

"But there’s more to precious metals than the excitement in the yen. That’s clearest in silver, always more speculative than gold. It passed $100 per ounce for the first time last week. This is what happened Tuesday:"

"Yen intervention at a time of such febrile activity certainly suggests risks. The currency isn’t their sole cause. What’s happening in Japan is of profound importance to the country, and will matter beyond its borders. But it needn’t drive an international crisis."

Source: John Authers, Bloomberg, Opinion Points of Return, January 27, 2026

Since this was published on January 27, 2026, we witnessed a massive sell-off in Gold and Silver, now recovering. Again reminders of these uncertain times.

The Red Lines:

Debasement trades (weak US dollar) implies "sell America" or a decline in value of US assets. America needs dedicated buyers of US Treasuries to keep long-term interest rates from climbing. A strengthening US dollar may be the answer to lower Treasury yields.

Declining trust and adverse trade and geopolitics developments together with uncertainties will challenge the safe-haven reputation of the US dollar.

Unimaginable #6): A Building Boom in the Developed Markets

Housing shortages have been a real albatross around the necks of most of the developed economies, esp. in the USA and Europe. Somehow building more and increasing the supply, an obvious solution is only regarded a one of last resort. Affordability is THE theme in this election year and if the parties can come up with a solution to create ownership and a greater chance for the middle class to grow wealth, it may be a winning formula. It should also bring rent prices down. All this seems somehow unimaginable...

The Red Lines:

Rising Unemployment and signs of finding work get harder

Because of the inequality this all symbolizes, people take to the streets or go on strike for higher wages.

Unimaginable #7): Away from the Algorithm and into the Analog — Analog is Cool!

Just imagine meeting people in person again! Or reading real books and writing real letters. People join clubs and learn hobbies that minimize differences through common interests. No more hiding in anonymity--take off those masks! Social engagement is said to be the best solution in combating depression and self-harm. It is also fun making new friends!

The Red Lines:

If and/or when Social Media platforms lose current cases brought against them not arguing content abuse, but rather the use of algorithms creating addiction and self harm.

Schools forbid Smartphones in the classroom and other moderation requirements creating greater costs when not compliant.

Unimaginable #8): A Return to Nature Coupled With a Trend of Being Cool Without Extraordinary Wealth

Back in the '70’s after the 1966 Stock Market Peak and major social disruptions and change, it was actually a trend when you didn’t need a lot of money to have a fun and adventuresome life. It was reflecting the massive social change offering great chances and experiences for ordinary people. If you couple the Unimaginable #6 with this one, social mobility will spread and we may even get back our middle class. Unimaginable?

The Red Lines:

Affordability influences inspiring trends away from luxury towards practicality and healthy aspirations.

Unimaginable #9): What about China? Victory for Ukraine?

Since the Russian attacks on Ukraine in February 2022, there has been occasional speculation that China may be emboldened to do the same for Taiwan. What is unimaginable is that Taiwan speculation is a distraction and that the Chinese are rather planning to “get back” former Chinese territory in Russia. Russia is rich in energy and minerals. Russia is weakened substantially with their focus on Ukraine and other former Soviet States. Unimaginable? This and a viable solution favoring Ukraine would put Europe in a stronger position and of course China too.

The Red Lines:

Nothing clear, it would have to be a subtle move by China... A bold move for Ukraine...

Conclusion:

2025, the Year of the Snake-Ouroboros was hardly contemplative, more chaotic and energetic by moving fast and breaking things. Moving fast in politics (emergency orders), in government (DOGE), Artificial Intelligence in the race to CGI, and breaking the old world order into regional hegemonies. Is any of this working? 2026, the Year of the Horse brings an abundance of positive energy with solutions which may look very different than those breaking things anticipated. It will also have its own elements of chaos, deliberate or not. Let’s see if we can get back fair and invigorating democracies, leaner and more efficient government bureaucracies, growth and confident middle powers (checks and balances) and middle class, more social interaction and less anonymity/anamosity. A building of bridges and lasting peace—free, fair and justice for all. Now that’s a Rupture! Unimaginable?

Now for the Fun Part -- Some Chinese Year of the Horse Predictions:

Let’s see some predictions for the rupturing Year of the Horse and what is in store for us complements of Gemini AI:

For those of you who are curious, maybe a bit superstitious take a look at what I learned from asking Google-Gemini AI — funny it likes or has a bias towards Japan! I added some more details directly from this Feng Shui Academy link! These are not my ideas and anyway are mostly general and descriptive. Enjoy!

https://www.thefengshuiacademy.com/year-of-the-fire-horse-2026/#:~:text=The%20Financial%20Engine%3A%20Fire

%20represents,significantly%20from%20February%20to%20July

For Investors:

2026 is the Year of the Fire Horse in the Chinese zodiac (starting February 17, 2026), symbolizing momentum, bold action, speed, and opportunity, leading financial analysts to anticipate a year of high energy, potential breakthroughs, and volatility, with focus on decisive moves, innovation (like AI), and potentially significant shifts in markets like Japan's economy, suggesting a dynamic, opportunity-rich, but potentially risky environment for investors.

Key Themes for Financial Markets in 2026 (Year of the Fire Horse):

- Momentum & Action: Expect forward movement, faster manifestations, and a push for rapid change, requiring proactive investment rather than observation.

- Boldness & Opportunity: The Fire Horse encourages courage, ambition, and seizing unexpected chances, with potential for significant gains for those who act decisively.

- Volatility & Risk: The combination of fire and horse suggests high energy, intensity, and unpredictability, leading to more rotations and potential volatility.

- Specific Market Focus (Japan): Analysts foresee major shifts, including accelerating inflation, potential interest rate surges, and a supply-side revolution, making Japan a key market to watch.

- Tech & Transformation: A strong link to innovation, especially AI, and the transformation of finance through tokenization, suggesting growth through structured, compliant adoption.

Investor Sentiment:

- Optimism for Growth: Many anticipate strong corporate earnings, robust economic activity (especially in Japan), and a continuation of the bull market.

- Strategic Positioning: Investors are advised to be active, reallocating towards tangible assets like gold for hedging, and making bold moves.

- "Act, Don't Just Observe": The general consensus is that 2026 is a year for taking clear, action-oriented steps to achieve significant results, moving past the cleansing year of the Snake.

-

Source: (Google Gemini AI)

Historical S&P 500 Performance in Horse Years

Historically, the S&P 500 has seen varied, but on average weaker, returns during past Horse years (I put in RED what I wrote back in 2014 comparing market forces to the '30s).

|

Horse Year |

Element |

S&P 500 Performance Note |

|

1930 |

Metal |

Significant loss (-28.5%), coinciding with the start of the Great Depression. |

|

1942 |

Water |

Mid-WWII period. |

|

1954 |

Wood |

Strong gains (+45%). |

|

1966 |

Fire |

Notable decline (-13.1%). Stock Market Valuations Peak |

|

1978 |

Earth |

Period of economic uncertainty. |

|

1990 |

Metal |

Market decline. |

|

2002 |

Water |

Large loss (-23.4%), post dot-com crash. |

|

2014 |

Wood |

Period of market growth.** |

|

2026 |

Fire |

Predicted volatility; fortune favors the brave but tests the unprepared. |

From The Fengshui Academy: :"The 2026 Yang Fire Horse is a year of rejuvenation and renewed momentum. While the “Peach Blossom” star brings romance and the “Double Fire” fuels the financial engine of the global economy, the atmosphere remains volatile. Success this year depends on harnessing the Sun’s radiant energy while avoiding the pitfalls of hot-tempered impulsivity. By protecting your South and North sectors and focusing on Water-related industries (Telecommunications, Shipping, Logistics, Spas), you can navigate the heat of the Horse with grace and profit.

- "Spotlight: Telecommunications (Water Element)Telecommunications is a Water industry because it facilitates the flow of data. In 2026, the intense Fire symbolizes Money and Opportunity for this sector. We expect a massive surge in 6G development, AI-integrated communication, and satellite technology. While highly profitable, the “Double Fire” warns of network “overheating” or rapid, disruptive technological shifts.To know more about how each animal sign is going to perform in 2026, feel free to connect with us at info@thefengshuiacademy.com" and

https://www.thefengshuiacademy.com/year-of-the-fire-horse-2026/#:~:text=The%20Financial%20Engine%3A%20Fire%

20represents,significantly%20from%20February%20to%20July

Disclaimer Note: Chinese zodiac predictions are based on cultural traditions and should not be considered as financial advice. Market performance is influenced by complex economic factors.

APPENDIX:

- From Gemini AI: Recommended Sources & Links

For detailed annual forecasts, you can explore the insights from these specific authorities:

- The Fengshui Academy: Provides a deep dive into the "Double Fire" engine and industry-specific winners.

-

Indosuez Wealth Management: Offers a professional financial outlook on "Taming the Fire Horse" through selective investing and global asset allocation.

- BusinessToday (Joey Yap Interview): Focuses on how the "Fire Horse" is reshaping the "plumbing" of traditional finance and crypto.

- South China Morning Post (SCMP): A great overview of how the fire energy affects personal and corporate

- Bloomberg Opinion: Don’t Fall for the Myth of the ‘Brittle’ Strongman (Bloomberg)

Which raises another question: How long will this new world last? Will the strongmen burn themselves out and the rules-based global order reassert itself? Or are we in for the long haul? Liberals like to approach this problem with the help of a paradox: Strongman regimes are much weaker than they appear, and democratic regimes much stronger. Strongmen may take history by the scruff of the neck, but their regimes are “brittle.” Liberal leaders may dither and dawdle, but they have hidden strengths. Strong is weak and weak is strong: We just need to wait until this underlying logic plays itself out.

- From NPR Planet Money: The Indicator -- All these Data Centers are Going to Fry My Electric Bills...Right?

Data centers are getting a lot of heat right now. There’s neighborhood pushback against them for water usage and environmental concerns, and some politicians on both sides of the aisle aren’t fans for the same reasons. There’s also fear that they could drive up the cost of electricity bills.

But that last bit isn’t set in stone.

Data center electric bill upcharge is not a guarantee. In fact, it is even possible for data centers to cause power bills to go down. Today on the show: the future of your power bill.https://podcasts.apple.com/de/podcast/the-indicator-from-planet-money/id1320118593?l=en-GB / https://open.spotify.com/episode/3YVPhmDjUFMNvc6gqSgU3q?si=MIhiPPvARUKv5mAyczt8oA

- Bubbles explained from NPR's Planet Money:

https://podcasts.apple.com/de/podcast/planet-money/id290783428?l=en&i=1000744530372. // https://open.spotify.com/episode/6lcrWZYf8bhP20FHX5GFIu?si=_sMshOFkQga_WntNWT_sJA

Are we in an AI bubble? That’s the $35 trillion dollar question right now as the stock market soars higher and higher. The problem is that bubbles are famously hard to spot. But some economists say they may have found some telltale clues.

How do economists detect a bubble? And, how much should society be worried about bubbles in the first place?

- AI and Bursting Bubbles: Prof G Markets Podcast: https://open.spotify.com/episode/2SVuWhu0cUwp8ZeKuQzz7l?si=52aXTwJhQyaYyqJWiE0pug

- **History Repeats Itself 2014 was also the year of the horse—powerful stock market!

"History Repeats Itself: Market Parallels to the ‘30s Financial Crisis Inspired by a Book https://acrobat.adobe.com/id/urn:aaid:sc:eu:959f21e3-94f9-4e52-8c8e-34f7af2c20b5)

- From the New Yorker: Compare this to 'Poor is cool in the 70s': Limited followers on social media is the new cool: "It’s Cool to Have No Followers Now!" https://www.newyorker.com/culture/infinite-scroll/its-cool-to-have-no-followers-now

- A more extensive appendix from my blog piece in November 2025:

“Predicted volatility; fortune favors the brave but tests the unprepared”